Repertorio delle banche italiane

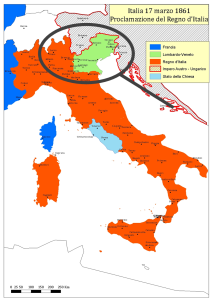

Concluso il progetto pilota (Piemonte, Valle d’Aosta, Liguria), l’Istituto ha avviato la seconda fase (Lombardia, Veneto, Trentino-Alto Adige, Friuli-Venezia Giulia) della realizzazione del Repertorio digitale – www.bancheitaliane.org – che censirà tutti i soggetti che, dall’Unità ad oggi, hanno erogato il credito in Italia.

Einaudi e l’associazionismo economico

L’Istituto ha avviato un programma di ricerca in tre fasi volto all’approfondimento del pensiero di Luigi Einaudi sulla rappresentanza degli interessi, di cui sono portatori imprenditori e lavoratori, con specifico riferimento all’associazionismo bancario. I primi due volumi pubblicati coprono il periodo 1899-1939.

Banche e agricoltura

Si intende approfondire l’apporto che il capitale impiegato, per il tramite dell’intermediazione creditizia, nel settore agricolo ha assicurato al processo di crescita economica dell’intero Paese, inquadrando il ragionamento all’interno di una più ampia analisi storica del rapporto tra banche e territorio. Il primo volume pubblicato copre il periodo 1861-1946.

Archivio Storico ABI

Archivio Storico ABI

L’archivio storico dell’Associazione Bancaria Italiana custodisce uno straordinario giacimento di documenti prodotti e conservati dall’Associazione nel corso dei suoi 100 anni di storia ed è stato dichiarato di “notevole interesse storico” dalla Sovrintendenza archivistica del Lazio. Su richiesta dell’ABI, l’Istituto ha realizzato un significativo progetto di riordino e di valorizzazione.